The world is waking up to the bursting of the Western debt Superbubble.

The US situation is dire.

While Congress fights about increasing government debt – by another few trillion dollars. Venture capitalist David Sacks reminds us that the money is already gone:

What's so stupid about our budget process is we spend the money and then argue about whether we're going to pay the credit-card bill.

And hotshot investor Stanley Druckenmiller paints the bigger picture:

All this talk about the debt-ceiling is sitting on the Santa Monica Pier — And you’ve got a 30-foot wave coming in, and you’re worried about the Santa Monica Pier being damaged. But you know 10 miles out is a 200-foot tsunami.

Druckenmiller also points out that — with entitlements — the US debt load is closer to $200 trillion than the $31.4 trillion that USG pretends is owed.

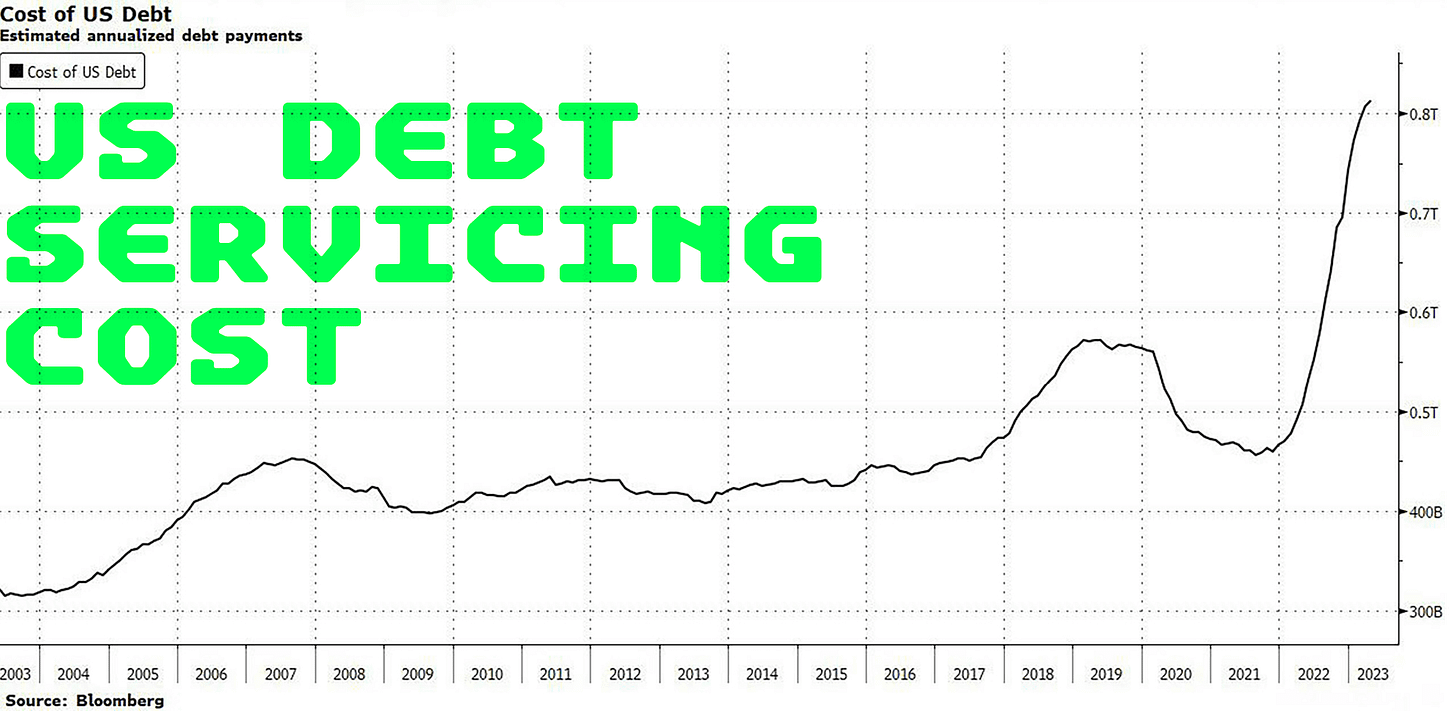

On top of that, the US government now spends more on servicing its super-crazy debt burden than on its military …

Meet the the new boss …

Jake Jeremiah Sullivan is President Biden's National Security Advisor.

Recently, he made a speech outlining USG's vision for the world economy.

Redesigning the global trade system to meet US needs is Jake's remit because the failure of the US economic model threatens national security.

The advisor advises America to create:

“A just and effective clean energy transition” … “That promotes diversified and resilient global supply chains” … “Mobilizing public and private investment for a just clean energy transition and sustainable economic growth” … “Ensuring trust, safety and openness in our digital infrastructure” … “A virtuous cycle ensuring our competitors aren't gaining an advantage by degrading the planet.”

Turns out Greta had a point:

"Blah blah blah"

But Greta's complaint is that Western governments aren't doing enough.

Jake tells you that something else is being attempted, and they will do more of that thing than human minds can comprehend.

Ursula, Christine and Olaf

Jake's predecessors as United States National Security Advisor include Henry Kissinger and Zbigniew Brzezinski. They were not economic experts, but they were very good at getting foreign leaders to do things that were bad for their countries.

It was clear that Jake was addressing a special someone in his speech: Ursula von der Leyen received several flattering mentions.

But why? As empire shrinks, USG tightens its grip on G7 friends and allies (the EU, Japan, and the other Five Eyes Anglo nations).

Jake calls this a "small yard, high fence" economic security strategy.

The fence is being erected around Westerners who consume most of the world's resources — in return for dollars and euros typed into existence at almost no cost.

Some people like this deal less than others.

For the US, Jake's high fence would work very nicely. Nature blessed them with most of the natural resources it needs. But Europe is finding out that the USG's economic fence can imprison as well as protect.

Europe relies on fossil fuels provided by the autocrats and theocrats. Without that energy, European society can only devolve.

Unfortunately, renewables are nowhere near ready to deliver the energy modern civilizations require ... And they won’t be for decades.

Biden's Inflation Reduction Act was a shocker for EU friends. It was seen as a program to crush German industry and make Europe poor.

So why do the latest crop of European leaders support such anti-Europe measures?

Note 1: the EU lacks its own army, intelligence services, spooks, and spies. It outsources these functions to member states and USG.

Note 2: Ursula — like Christine Lagarde and Olaf Sholz — has corruption scandals bubbling in the background.

I assume that Jake — like Putin and Xi — gathers information that could encourage EU leaders to act against European economic interests — in ways that benefit the United States.

But I don't know.

I also don't know who blew up the Nord Stream 2 pipeline. Seymour Hersh believes Jake had a lot to do with it …

But enough conspiracy theory. There is a planet to save.

Billions and trillions

Jake says that USG will be "mobilizing trillions of dollars in investment" to avert the catastrophes of climate change.

Primate brains were not made to deal with such enormous numbers. It might be easier to understand:

a billion seconds as 31 years and 8 months.

a trillion seconds as 31,709.8 years.

But that does not clarify what "trillions of dollars" are.

Bank of America was more exact, claiming that fighting climate change will cost $150 trillion.

Globo-bank UBS added $10 trillion to that price tag.

One hundred and sixty trillion dollars is double $83 trillion — which is the entire global money supply.

No-one can doubt the goodness of Western governments and NGOs and the mega-banks.

And it is an interesting coincidence that the financial industry has positioned itself at the forefront of the biggest business opportunity in the history of this planet.

But what if they're wrong?

Green QE

Back in 2021, I asked Luke Gromen if climate change could justify the massive money-printing required as the global debt Superbubble bursts.

His answer:

I would not be surprised at all, if we wake up in a year, two years, three years and find the need for central banks to do Green QE. And who can argue Green QE? Because it'll just be good for the environment. But what will be happening is effectively kicking the sovereign debt bubble upstairs to sort of a global climate change/debt project.

Looks like we got there.

Print money, buy time

In the last 101 years, the global financial system has been kept alive by making more and more government promises.

In recent years, the Fed and ECB continually enact programs like QE and TARP and Reverse Repos and BTFP and OMT and PEPP and APP and TLTRO — in the name of doing "whatever it takes" to prevent systemic collapse.

Eventually, we end up with giant piles of promises that cannot be kept.

These piles of promises are financial bubbles — and the one bursting now is the biggest yet.

And Jake has announced that climate change has been selected as the cover story for the tidal wave of money that will flood the West in the coming months and years.

Of course, this creates huge opportunities for those positioned to benefit from all that goodness swilling around the financial system.

But for everyone else, money printing will not disguise the accelerating decline in Western/European living standards.

Solving debt problems with more debt can work — up to a point. That point is the devaluation and destruction of currencies.

We're going close.

x C x